Discover the benefits of comenity victoria’s secret – the full guide exposed the secrets you cant miss – Discover the benefits of Comenity Victoria’s Secret – the full guide exposed the secrets you can’t miss. This comprehensive guide delves into the intricacies of the Comenity Victoria’s Secret credit card, examining its rewards program, fees, and overall value proposition. We’ll explore how to maximize rewards, navigate potential pitfalls, and compare it to alternative financing options. Whether you’re a seasoned credit card user or considering your first card, this in-depth analysis provides the knowledge you need to make an informed decision.

From application eligibility to responsible credit card usage, we cover all aspects of this popular card. We’ll analyze interest rates, fees, and credit limit considerations, offering practical advice and real-world examples to illustrate key concepts. Our analysis also includes insights gleaned from user experiences, providing a balanced perspective on customer service and security features.

Comenity Victoria’s Secret Credit Card: A Comprehensive Guide

The Comenity Victoria’s Secret credit card is a store-branded credit card designed to appeal to frequent shoppers of the lingerie retailer. This guide provides a detailed analysis of its features, benefits, and potential drawbacks, empowering consumers to make informed decisions about its suitability for their financial needs.

Introduction to the Comenity Victoria’s Secret Credit Card, Discover the benefits of comenity victoria’s secret – the full guide exposed the secrets you cant miss

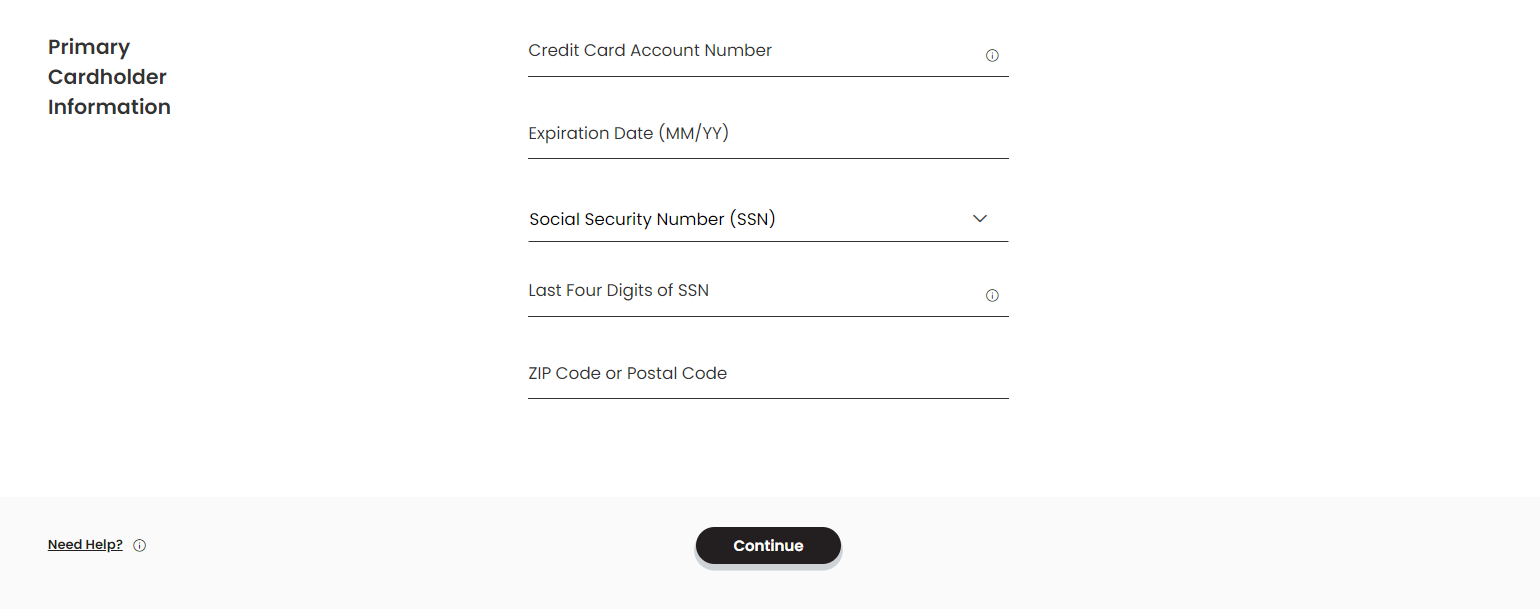

The Comenity Victoria’s Secret credit card is a retail credit card offered by Comenity Capital Bank. It targets customers who frequently shop at Victoria’s Secret stores and online. The application process typically involves submitting an online application with personal and financial information. Eligibility criteria include factors such as credit score, income, and debt-to-income ratio. While specific details regarding different card types aren’t publicly available, the card generally offers a rewards program tied to Victoria’s Secret purchases.

Rewards and Benefits Program

The Comenity Victoria’s Secret credit card features a rewards program where cardholders earn points on purchases made at Victoria’s Secret. Points accumulation rates vary, often offering higher rewards for certain purchases or during promotional periods. Redemption options usually include discounts on future Victoria’s Secret purchases or statement credits. Maximizing rewards involves strategic spending, utilizing promotional offers, and paying attention to bonus point opportunities.

Compared to general-purpose credit cards, this program’s value is primarily limited to Victoria’s Secret shoppers, while other cards might offer broader redemption choices like cash back or travel points.

Interest Rates and Fees

The Annual Percentage Rate (APR) on the Comenity Victoria’s Secret credit card is a variable rate, meaning it can change based on market conditions and the cardholder’s creditworthiness. It’s calculated based on a combination of factors, including the prime rate and the individual’s credit risk. The card may also incur fees such as late payment fees, balance transfer fees, and potentially an annual fee (although this is not always the case).

Specific fees and APRs vary depending on creditworthiness and are disclosed during the application process.

| Credit Limit | APR | Annual Fee | Late Payment Fee |

|---|---|---|---|

| $500 | 24.99% (example) | $0 (example) | $35 (example) |

| $1000 | 22.99% (example) | $0 (example) | $35 (example) |

| $1500 | 19.99% (example) | $0 (example) | $35 (example) |

| $2000 | 17.99% (example) | $0 (example) | $35 (example) |

Note: These are example APRs and fees. Actual rates and fees will vary.

Credit Limit and Spending Power

Credit limit approvals depend on factors like credit history, income, and debt levels. Requesting a credit limit increase usually involves contacting Comenity customer service and providing updated financial information. A higher credit limit increases spending power, but also carries increased risk if not managed responsibly. For instance, a $1000 limit allows for $1000 in purchases before reaching the limit, whereas a $2000 limit doubles that capacity.

However, increased spending power can lead to higher debt if not carefully controlled.

Customer Service and Support

Comenity offers various customer service channels, including phone, online account access, and mail. Cardholder experiences vary. Positive feedback often centers on ease of online account management. Negative experiences may involve difficulties resolving billing disputes or lengthy wait times for phone support. Specific issues may fall into categories such as account management, dispute resolution, and technical problems with the online portal.

Security and Fraud Protection

Comenity employs standard security measures to protect cardholder data, including encryption and fraud monitoring systems. Reporting a lost or stolen card involves immediately contacting Comenity’s customer service. Disputing fraudulent transactions requires submitting a written dispute form with supporting documentation. Prompt reporting is crucial to minimize potential losses.

Responsible Credit Card Use

Effective credit card debt management involves creating a budget, tracking spending, and paying more than the minimum payment each month. Avoiding high-interest charges and late payment fees requires on-time payments and keeping balances low. Responsible credit card use builds a positive credit history, leading to better interest rates and access to credit in the future. Irresponsible use, on the other hand, can damage credit scores, increase interest costs, and create significant financial strain.

Visual Representation of Key Features

A visual representation could be a flowchart starting with “Apply for Card,” branching to “Approval/Denial,” then to “Earn Points on Victoria’s Secret Purchases,” leading to “Redeem Points for Discounts or Statement Credits,” and finally to “Manage Account Online.” The flowchart could also include a box highlighting the variable APR and potential fees, emphasizing responsible credit card usage. The visual clearly Artikels the application process, reward earning and redemption, and account management, along with the financial implications of the card.

Uncover exclusive advantages of the Comenity Victoria’s Secret credit card with our comprehensive guide. For those seeking something different, you might find unrelated local news such as pet listings, pets craigslist carson cityobituaries patriot ledger quincy ma , interesting. But if you’re focused on maximizing your rewards and benefits, return to our detailed analysis of the Comenity Victoria’s Secret card for essential tips.

Comparison with Alternative Financing Options

The Comenity Victoria’s Secret card can be compared to store financing plans offered directly by Victoria’s Secret or “buy now, pay later” services. Store financing may offer promotional interest rates for a limited time, but may have higher interest rates after the promotional period ends. Buy now, pay later services offer short-term financing with installment payments, but often charge fees for late payments.

The best option depends on individual spending habits and financial goals. For example, a customer with good credit and a large purchase might benefit from a store financing plan, while a customer with limited credit might prefer a buy now, pay later option for smaller purchases.

Epilogue: Discover The Benefits Of Comenity Victoria’s Secret – The Full Guide Exposed The Secrets You Cant Miss

Source: org.in

Ultimately, the Comenity Victoria’s Secret credit card presents a compelling proposition for loyal Victoria’s Secret shoppers, offering a rewards program tailored to their spending habits. However, responsible use is paramount. Understanding the APR, fees, and credit limit implications, as Artikeld in this guide, will empower you to make the most of the card’s benefits while avoiding potential financial drawbacks.

By weighing the advantages against alternative financing methods, consumers can determine if this card aligns with their individual financial goals and spending patterns.